The registered office of Ndx P2P Private Limited is at "1st Floor, B-104, "The Qube" having C.T.S. The Corporate Identification Number (CIN) of Ndx P2P Private Limited is U67200MH2018PTC306270. Ndx P2P Private Limited has two directors - Gautam Dineshkumar Adukia and Achal Mittal. Also, as per our records, its last balance sheet was prepared for the period ending on 31 March, 2021. The last reported AGM (Annual General Meeting) of Ndx P2P Private Limited, per our records, was held on 30 November, 2021. The current status of Ndx P2P Private Limited is - Active. Other performance and liquidity ratios are available here. At the same time, it's book networth has decreased by -39.54 %. It's EBITDA has increased by 29.97 % over the previous year. Ndx P2p Private Limited's operating revenues range is INR 1 cr - 100 cr for the financial year ending on 31 March, 2020. It's authorized share capital is INR 22.00 lac and the total paid-up capital is INR 1.69 lac. It is classified as a private limited company and is located in Mumbai City, Maharashtra.

THE CURRENT BEST P2P 2018 DOWNLOAD

To download a (free) copy of the Q2/Cornerstone report Fintech Adoption in the United States: The Opportunity for Banks and Credit Unions, click here.Ndx P2P Private Limited is an unlisted private company incorporated on 12 March, 2018.

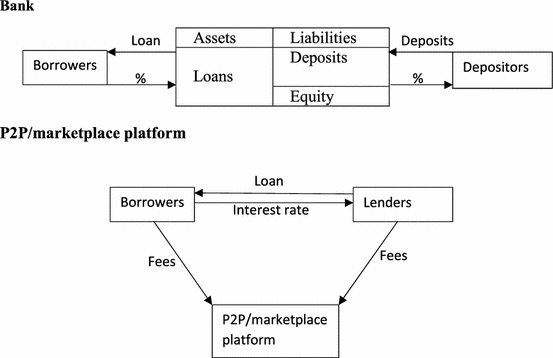

On the other hand, Zelle's potential move into B2B payments may help banks improve their small business and commercial banking offerings, compensating for the tough economics on the retail side.Īdopting Zelle might be the right thing for an institution-but it will only know it's the right answer if it understands how P2P payments fits into it checking account and payments strategy. Will offering Zelle help them stem that tide? With the threat of PayPal/Venmo, Apple Pay, and Square Cash moving into retail payments, those services may cannibalize banks' existing debit activity. What's our checking account (and payments) strategy going to be?" Unfortunately, it's the wrong question to ask. The more important question to deal with today is: Many are currently wrestling with this question.

When consumers use Venmo to pay their rent to a property management company or pay a lawn service for cutting the grass, are those P2P or B2C payments? The lines between P2P and B2C are blurring.Market Cap Monero’s current market Cap in terms of USD is 706,145,634. And the chart below indicates a steady growth over the past 3 years. Fighting deposit displacement might be the best argument here. Current Trends Currently, Monero is priced at 48.17. I've heard that for the past 20 years with every online (and now mobile) feature that comes along. Regardless, with no direct revenue coming in from these transactions, what's the economic benefit? Please don't give me the "deeper engagement" or "retention benefit" story. The transaction costs for Zelle transactions are not insignificant (although there is conflicting information floating around out there about what those costs are). Zelle's economics are a tough pill for banks to swallow.As Zelle brings on the 170 banks in the queue (and those that follow), more consumers will become Zelle users by default. When I first started transferred money to my kid's account they weren't Zelle transactions-but now they are. Not because I choose to use Zelle, but because my bank is a Zelle bank. For example, if there are people I regularly text with (using our iPhones), and they don’t care that the money will go onto an Apple Pay cash card instead of into their bank account, then I might pay them using Apple Pay-bypassing Venmo and Zelle altogether. This isn't a winner-take-all battle. People will choose the P2P app that is most convenient to them at the moment they want to do something.The answer-which no one will like-is "no one." Zelle can point to its impressive growth rates and transaction volume, but I wouldn't pronounce them the winner of the battle for four reasons: Survey of 2,015 US consumers, Q4 2017 Source: Cornerstone Advisors

0 kommentar(er)

0 kommentar(er)